The company recently posted record results for the first quarter of fiscal year 2024, with record double-digit revenue growth achieved in more than 20 countries. The company reported revenues of $119.6 billion for the December quarter, up 2% year-over-year. iPhone revenue was $69.7 billion, up 6% year-over-year. Mac revenue was $7.8 billion, up 1% year-over-year. Services revenue grew at a double-digit pace year-over-year, rising 11% to $23.1 billion. Excluding all company expenses, net income rose 3.9% to $33.9 billion. Apple’s active devices set a new record, with more than 2.2 billion people worldwide currently having an active product.

Apple Inc. (AAPL-NASDAQ) is also currently developing a revolutionary technology, personal robotics for use in the home. Services such as the App Store, TV+ and Apple One packages also ultimately depend on the iPhone and other devices to function. Therefore, it is imperative that the company stays at the forefront of hardware innovation and keeps up with the competition in the AI space, and the new personal robotics industry will be a great boon. Apple Inc.’s business remains heavily dependent on iPhones, which account for more than half of its revenue.

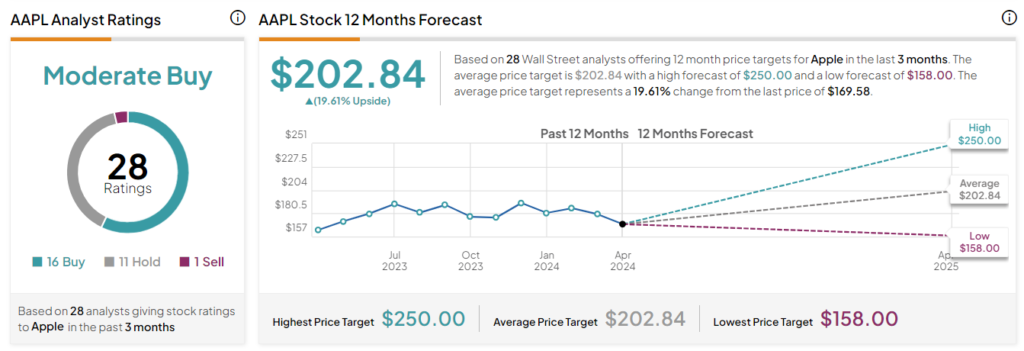

Graph Source : www.tipranks.com

Apple Inc (AAPL-NASDAQ) pays regular quarterly attractive dividends to its shareholders. The dividend yield is currently 0.57% p.a. The actual dividend amount has been approved by the company’s shareholders at $0.24 per share. The average target price has been set by tipranks.com analysts for the short to medium term investment horizon at USD 202.84 per share.