LVMH

Fundamental analysis

LVMH Moët Hennessy Louis Vuitton is a company based in Paris. Today, the LVMH group includes 75 luxury brands in various sectors with a turnover of 79 billion Euros (2022) and a network of more than 5,600 stores worldwide.

The company was founded in 1987 by the merger of the fashion house Louis Vuitton and Moët Hennessy. In 2023, LVMH is the first European company to exceed a valuation of USD 500 billion (almost twice the GDP of the Czech Republic), making it the most valuable company in Europe.

The list of companies belonging to the LVMH group includes Tiffany & Co., Christian Dior, Fendi, Givenchy, Marc Jacobs, Stella McCartney, Loewe, Loro Piana, Kenzo, Celine, Sephora, Princess Yachts, TAG Heuer, and Bulgari.

The company pays a dividend. The standard annual dividend was €12 per share in April 2023. A subsequent dividend of €5.50 per share was announced in December 2023.

LVMH divides the business into the following categories. The turnover is for the year 2022 in millions of Euros.

- Wines & Spirits – 5 974

- Fashion & Leather Goods – 30,896

- Perfumes & Cosmetics – 6 608

- Watches & Jewelry – 8 964

- Selective Retailing – 11 754

LVMH is growing across markets. Its narrow focus on affluent to ultra-affluent clients provides it with some protection from the cyclical nature of its business (from which fashion and beverages in particular suffer). Even in times of crisis, the rich are still rich and can afford LVMH products.

Results

For the first 9 months of 2023, the company is growing by about 10% overall. However, there is a 10% decline in the Wines and Liqueurs section. - Wines & Liqueurs -10%

- Fashion & Leather Goods +11%

- Perfumes and cosmetics +8%

- Watches and Jewellery +5%

- Selected Retail +23%

In the Selected Retail Sales section, the Sephora brand was the main contributor to growth.

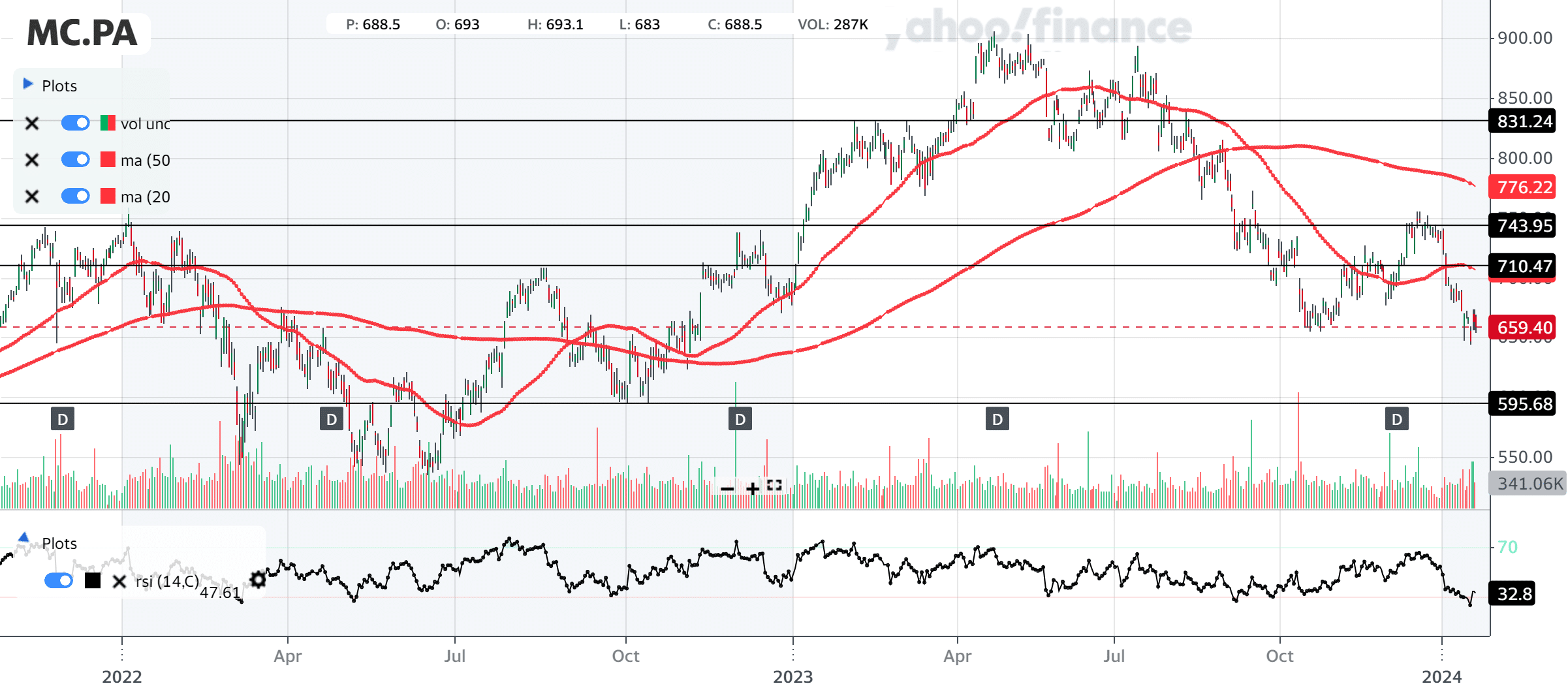

Technical analysis

The moving averages point to a downward trend. However, it should be taken into account that this is a decline from absolute highs. The RSI is in the oversold zone. The price is not near any significant resistance or support.

The PE is 20.

Conclusion

LVMH has a strategy built on continuously increasing the desirability of its brands. Luxury goods do not necessarily mean better, but it represents something that many customers desire but only a fraction can afford. That’s why LVMH is resilient to the economic cycles so familiar to the apparel business.

Over the past year, the company has done well, even if the share price doesn’t currently show it. But the full 2023 results are due in a week, and this report may change investor sentiment.

Sources

https://www.lvmh.com/news-documents/press-releases/new-record-year-for-lvmh-in-2022/

https://www.lvmh.com/news-documents/press-releases/2023-interim-dividend/

https://finance.yahoo.com/quote/MC.PA?p=MC.PA

https://seekingalpha.com/symbol/LVMHF

https://www.lvmh.com/news-documents/press-releases/organic-revenue-growth-of-14-in-the-first-nine-months-of-2023/

https://en.wikipedia.org/wiki/LVMH