Goldman Sachs Group, Inc. in the interest of investors

Goldman Sachs Group, Inc. (NYSE-GS) is an American multinational financial services company engaged in global investment banking, investment management, securities and other financial services, including asset management, mergers and acquisitions, prime brokerage advisory and underwriting. Goldman Sachs Group, Inc. also sponsors private equity funds, which are market makers and primary dealers in securities in the U.S. Goldman Sachs Group, Inc. also owns GS Bank USA. Goldman Sachs Group, Inc. was founded in 1869 and is headquartered in New York, USA. The company also has offices in international financial centers in more than 30 countries.

After Goldman Sachs Group, Inc.’s (NYSE-GS) foray into consumer banking failed, the company is refocusing on its traditional pillars, such as investment banking and trading. This year also marks the 25-year anniversary of the company’s initial public offering and stock market listing. Goldman Sachs also recently released its second-quarter 2024 earnings results, in which the common stock rose $8.62, or 10.9%. David Solomon, chairman and CEO of Goldman Sachs, said: “Our One Goldman Sachs operating approach allows us to bring the entire firm to our clients, deepen our relationships and enhance the quality and support in our complex environment.”

The Federal Reserve has slightly reduced Goldman Sachs Group, Inc (NYSE-GS)’s stressed capital reserve requirement after the bank requested an adjustment. Goldman Sachs’ requirement was cut to 6.2% from 6.4% after the bank provided additional information to the Fed in a statement Wednesday. The Goldman Sachs banking group said the adjustment resulted in a standardized common equity ratio effective Oct. 1, 2024.

Goldman Sachs Group, Inc (NYSE-GS) also pays regular quarterly dividends to its shareholders. The dividend yield is currently 2.19% per annum and the actual dividend amount has been approved by the company’s board of directors at $3.00 per share.

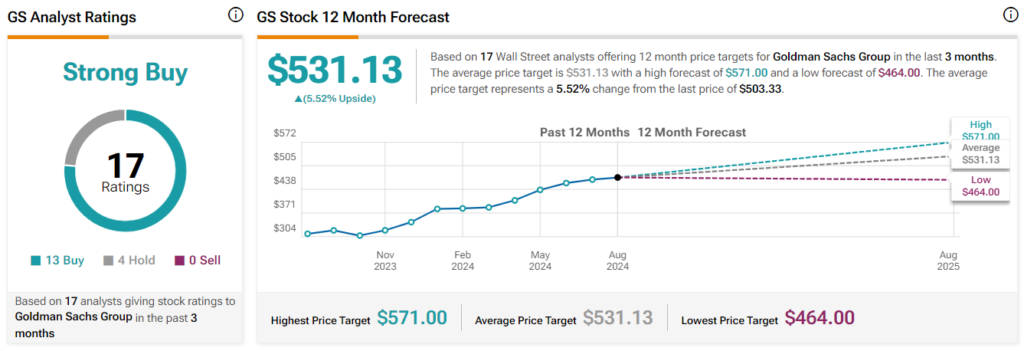

Goldman Sachs has increased its dividend by an average of 28.1% per year over the past three years and has increased its dividend annually for the past 13 consecutive years. The company has a dividend payout ratio of 28.8%, so its dividend is adequately covered by earnings. Global analysts expect that Goldman Sachs Group, Inc (NYSE-GS) will earn $41.40 per share next year, and the company should still be able to cover its annual dividend of $12.00. According to 17 Wall Street analysts, the stock price can be expected to rise in the short to medium term investment horizon, where the average target price has been set at $531.13 per share.

Graph Source : www.tipranks.com