Evolution of Microsoft shares

Shares of Microsoft Corp (NASDAQ-MSFT) have seen exceptional growth in 2024, confirming its current value of $423.46 per share. This increase, which is more than 60% from last year, is driven not only by strategic innovations and successes in artificial intelligence (AI), but also by growing interest in cloud services and other technology products.

Key growth drivers

1. Expansion in AI

Microsoft continued to expand its AI products and services in 2024, particularly within the Azure OpenAI platform. This move has attracted a wide range of enterprise customers looking for automation and productivity improvements. AI Copilot for Microsoft 365 is another example of a tool that has gained popularity among users.

2. Cloud services as a growth engine

The Azure segment, which includes cloud services, remains a key source of revenue for the company. The company is strengthening its position in the market due to steady growth in demand for cloud solutions and robust infrastructure.

3. Strategic acquisitions

The successful completion of the acquisition of Activision Blizzard has strengthened Microsoft’s position in the gaming industry. This allows for greater revenue diversification and better access to the interactive entertainment market, which continues to grow rapidly.

4. Long-term outlook

Over the past five years, Microsoft’s stock has increased in value by more than 250%. This demonstrates the strength of its business strategy, focused on growth in key areas such as artificial intelligence, cloud, gaming and enterprise software. Investors consider Microsoft to be one of the most stable technology companies with huge growth potential.

5. Outlook for the next period

Analysts expect Microsoft to continue to benefit from the demand for AI-enabled technologies and the expansion of its services ecosystem. Innovations in security and data protection, which the company is actively integrating into its platforms, will also be an important factor.

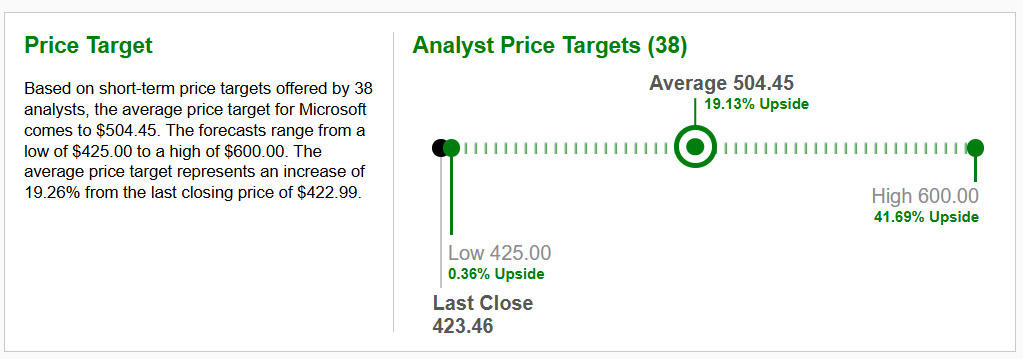

Microsoft Corp (NASDAQ-MSFT) also pays regular quarterly dividends to its shareholders. Currently, the dividend yield is 0.78% p.a. The actual dividend amount was approved by the board of directors at $0.83 per share. According to analysts at brokerage firms and financial strategists at investment banks, the share price can be expected to rise in the short to medium term investment horizon. The average target price for the short to medium term investment horizon was set at USD 504.45 per share.

Graph Source : www.zacks.com