Carrols restaurant group (TAST)

Fundamental analysis

Carrols restaurant group (TAST) is a franchise company. It operates the largest number of Burger King restaurants in the world and a large number of Popeyes restaurants. The company has been operating Burger King since 1976. It was originally called Carrols and operated its own Carrols hamburger restaurants, but in 1975 it changed all of its restaurants in the U.S. to Burger King. Other countries changed their restaurants later, the most recent being Finland in 2012.

As the demand for services (which includes fast food restaurants) grows after COVID, TAST’s sales and profits increase slightly.

Profit and sales are shown in millions of USD.

- 2019: sales 1,452, profit 211 (14.5% of sales)

- 2021: turnover 1,547, profit 242 (15.6% of turnover)

- 2022: turnover 1 652, profit 222 (7% of turnover)

- 2023: turnover 1 730, profit 211 (8,1 % of turnover)

Results

On 16 January 2024, Burger King announced that it will buy out the Carrols restaurant group in its entirety for a fixed price of $9.55 per share, a 13% premium over the 12 January 2024 price.

The company is growing across segments by approximately 7% in 3Q2023 versus 3Q2022.

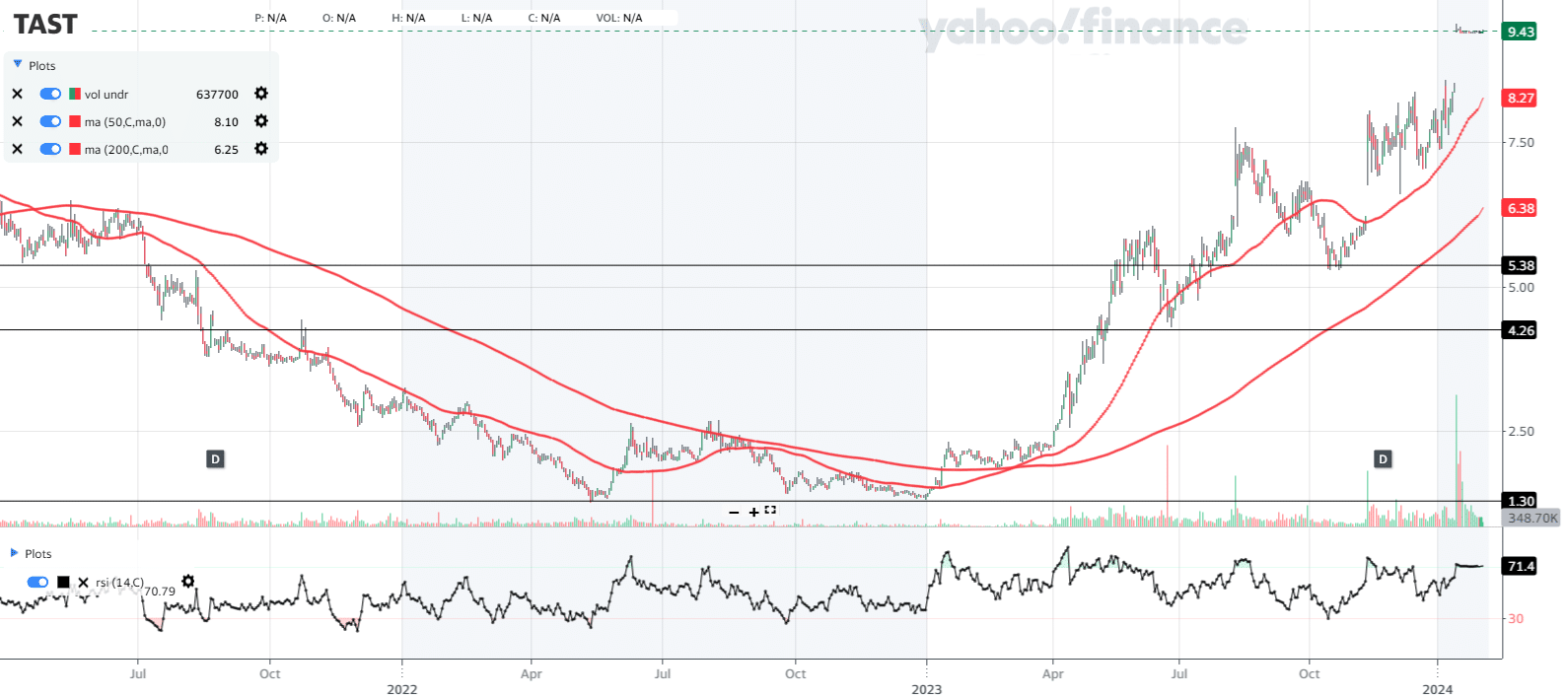

Technical Analysis

The company has been heavily influenced by fundamentals over the past two weeks. Currently, the price is around $9.40 per share, slightly below the 9.55 price target for buying. Historically, however, the price has also been at 17.50 per share.

TAST has been rising since March 2023 and has since risen from $1.30 per share to today’s $9.40 per share. The moving averages crossed to the upside just in March 2023, when the stock left the channel in the range of 1.50 to 2.50 per share. Since then, the price has steadily risen. The RSI has looked into the overbought zone a few times, but has been in the neutral zone most of the time.

Supports and resistances are very far from the current price. The closest one is at $10 per share.

Now the price is in a channel within a few cents.

Conclusion

Stock exits are happening, just as new IPOs are occurring. Over the past year, TAST has been a very growth stock. If Burger King’s purchase of TAST works out, nothing more will likely happen to the price. Factoring in the premium on the $9.55 price, an investor would currently get about a 1.2% return for holding its stock if it bought it now at $9.43.

However, it would be interesting if the purchase by Burger King does not happen for whatever reason. Then there is a very performing company with a decent yield that is well below its all-time highs.

Sources

https://seekingalpha.com/symbol/TAST/income-statement

http://investor.carrols.com/

https://investor.carrols.com/events-presentations

https://investor.carrols.com/static-files/a2434299-2066-436d-b3b3-4ccdd40bd7fb

https://investor.carrols.com/static-files/280b4278-3398-4bb8-9e53-7a3998aabdc9

https://finance.yahoo.com/quote/TAST?p=TAST&.tsrc=fin-srch

https://en.wikipedia.org/wiki/Carrols_Restaurant_Group