Visa Inc. in the interest of investors

Visa Inc. has made significant strides in the payments sector recently, with strong financial results and continued innovation. Visa’s business performance for its fiscal Q4 2024 reported solid earnings of $9.62 billion, beating estimates by $130 million. Along with that, Visa raised its dividend by 13%, bringing it to $0.59 per share. Visa Inc. has also recently made significant technological advances in payment methods. The company also continues to innovate in token technology, which has been used in more than 10 billion transactions. This system replaces sensitive data with cryptographic tokens that enhance the security of digital payments. It is estimated that this system has helped to reduce fraud by up to 60% and is now increasingly used.

The company is also focusing on global partnerships, for example working with Coinbase to integrate Visa Direct services for instant financial transactions.

The company is also expanding its Push-to-Wallet service for virtual cards across the commerce ecosystem. Global leader Visa Inc (NYSE:V) is expanding new features in digital payments to enable seamless push-to-wallet virtual cards. As a result, users can now seamlessly port virtual cards to mobile wallet ecosystems, including Apple Pay and Google Pay, with controls and security that enable precise spending limits and transaction tracking, minimizing the risk of fraud and unauthorized spending.

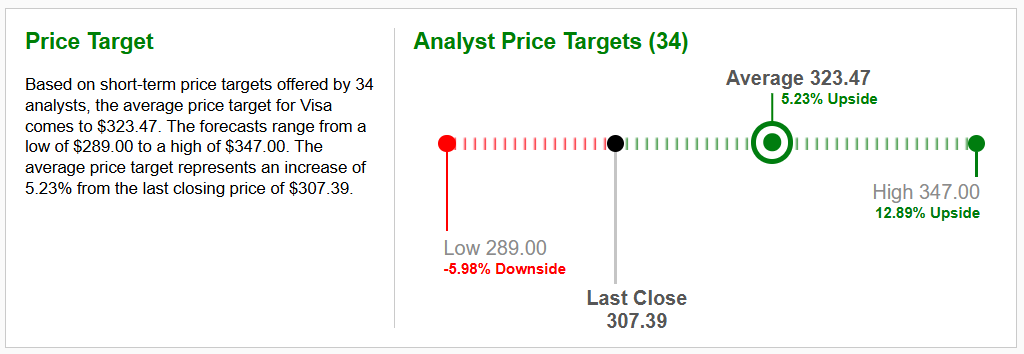

Visa Inc (NYSE-V) also pays regular quarterly dividends to its shareholders. The dividend yield is currently 0.77% per annum and the actual dividend amount has been approved by the company’s general meeting of shareholders at $0.59 per share. Due to the fact that the company has posted positive financial results for the fourth quarter of 2024 and the full year 2024, as well as the expansion of digital payment services to new features that will enable the seamless use of virtual push-to-wallet cards very popular for buying shares among private investors and multinational investment corporations, where according to analysts of brokerage companies and financial strategists of investment banks, the share price can be expected to grow in the short to medium term investment horizon. The average target price was set at USD 323.47 per share.

Graph Source : www.zacks.com