Microsoft Inc.

Microsoft Corporation (NASDAQ-MSFT) reported strong revenue growth for fiscal year 2024. Compared to fiscal year 2023, total sales increased 16% to $245.1 billion, driven by growth across all segments. Productivity and business process revenue increased due to Office 365 Commercial. Revenues in the personal computing sector increased due to gaming. Operating profit increased 17% to $109.4 billion. Gross margin increased due to improvements in the Azure interface, Office 365 Commercial and AI infrastructure. Net of all expenses, the company earned a net profit of $88.1 billion. The company has total assets of $512.1 billion and equity of $268.5 billion and employs 228,000 tribal employees.

Microsoft Corporation recently launched a large-scale investment in Floyd County, Georgia, on Huffaker Road in Rome. This investment will exceed $1 billion and will include the construction of a data center to support the Azure platform. “This is a tremendous economic opportunity for our community that will have positive impacts for decades to come,” said Jimmy Byars, Chairman of the Rome Floyd County Development Authority. The site itself is 347 acres in size. The company will also create 150 senior management jobs at the Georgia data center with this investment. This project is expected to take about three years to complete. Microsoft Azure (“Azure”) is Microsoft Inc’s global technology infrastructure, which consists of two key components – physical infrastructure and interconnecting network components. This technology infrastructure consists of more than 200 physical data centres, organized into regions and connected by one of the largest interconnected technology networks in the world.

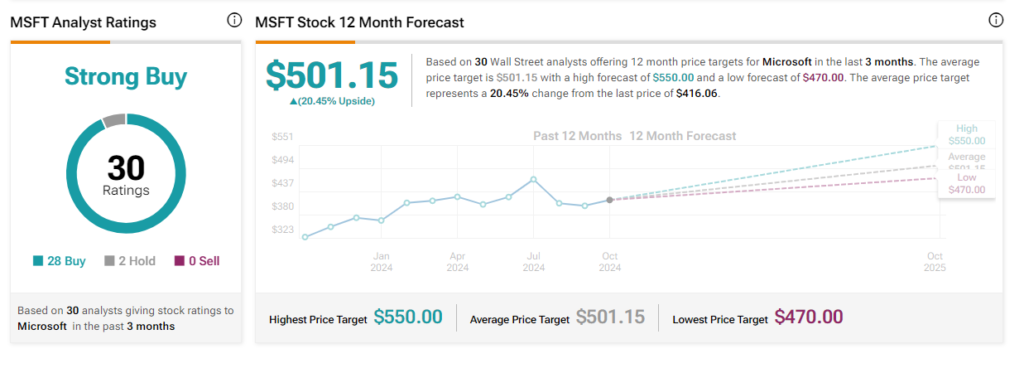

Graph Source : www.tipranks.com

The company also pays regular quarterly dividends to its shareholders. Currently, the dividend yield is 0.80% p.a. The actual dividend amount was approved by the AGM at $0.83 per share. The company also currently has a known date for the use of the stock’s dividend payment (NASDAQ-MSFT), the so-called Ex-Dividend-Date), which has been set for November 21, 2024. The company has set the actual dividend payment date (Pay-Date) for December 12, 2024. According to analysts at brokerage firms and financial strategists at investment banks, the stock price can be expected to rise in the short to medium term investment horizon. The average target price for the short- to medium-term investment horizon has been set at $501.15 per share.