Economic developments in the European Union

The outlook for economic growth in the EU has moved slightly higher this year, but is still below 1%. The publication of Eurostat’s first estimates of the economy’s performance in Q2 was a positive development. In which, according to the estimators, Eurozone GDP grew by 0.3% year-on-year, which was above the ECB’s expectations. Ireland and the Netherlands recorded the highest growth rates (1.2% and 1.0% respectively), while Lithuania and Spain also recorded brisk growth. On the other hand, Latvia suffered a contraction (-1.1%). The most talked about news, however, was the slight contraction in the German economy (-0.1%). Industry contracted for three consecutive months in June. Employment growth was 0.2% in Q2 and unemployment remains near an all-time low. Thus, the short-term outlook remains, even with the expected rebound in household consumption growth. GDP growth could pick up slightly in the second half of the year and reach just below 1% for the whole of this year, according to the IMF’s updated outlook.

Optimism about the recovery of the German economy has completely faded and the risk of a recession is back. GDP in the second quarter fell short of expectations compared to the previous quarter, instead economic activity unexpectedly contracted by 0.1%. According to the German Statistical Office (Destatis), there was in particular a fall in investment in equipment and buildings. After the German economy narrowly avoided a technical recession last year, the dynamics have now fallen again. The weak data thus do not look too favourable for the second half of the year. The IMF is now forecasting that GDP should grow by just 0.2% this year, with growth recovering to 1.3% next year. Consumer price growth was 2.6% year-on-year. The inflation rate was dampened in particular by the fall in energy prices (1.7%), while services prices continued to show above-average growth of almost 4%. Core inflation excluding food and energy stagnated at 2.9%. The CF now forecasts inflation at 2.4% this year and a slowdown to 2% next year. The decline in industrial producer prices slowed further to 1.6% y/y in June (vs. 2.2% in May), with lower energy prices remaining the main reason, as well as cheaper intermediate goods.

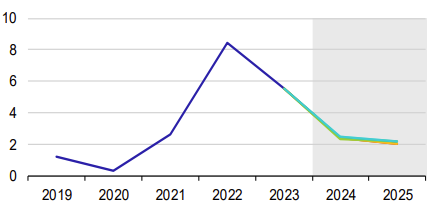

Inflace v EU v %

World economists expect an investment-led recovery in the coming year. Monetary policy is expected to start on the side of base rates. In the euro area, we expect the inflation target to be reached in the first half of 2026. Uncertainties and risks that may adversely affect the economic outlook of the EU, but also the world, have increased in recent months due to Russia’s protracted war against Ukraine and geopolitical tensions. If there are any negative significant developments in the world, some EU Member States could take additional measures for 2025, i.e. fiscal consolidation, which could impact economic growth next year. Climate change is also weighing on the current outlook of global economists.

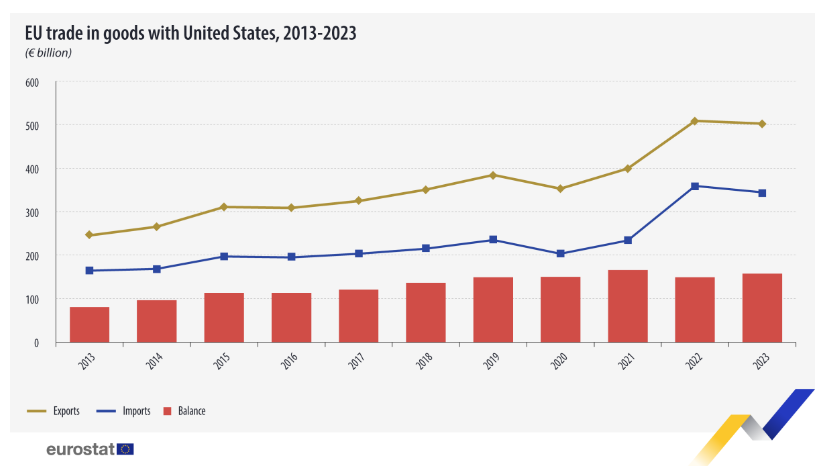

EU-US trade 2013-2023. source Eurostat