CABALETTA BIO, INC. in the interest of investors

Cabaletta Bio (NASDAQ:CABA) was founded in 2017. The company is headquartered in Philadelphia, PA, USA. The company is focused on developing T-cell therapeutics for the treatment of autoimmune diseases. The company collaborates with a number of professional institutions such as the University of Pennsylvania, Children’s Hospital of Philadelphia, and biotechnology company IASO Bio.

The company recently released financial results for the second quarter of 2024. The company generated total sales of $23.4 million. For the same period of the previous year, it was USD 11.8 million. General and administrative expenses were $6.9 million. On a year-over-year basis, it was $4.1 million. As of June 30, 2024, Cabaletta had cash, cash equivalents and short-term investments of $203.2 million and expects that its cash, cash equivalents and short-term investments will enable it to fund its operating plan through the first half of 2026.

In July, Cabaletta Bio (NASDAQ:CABA) entered into a new manufacturing agreement with Lonza, an industry-leading contract development and manufacturing organization (CDMO) that provides comprehensive, fully integrated drug development and manufacturing solutions and services to biotechnology and pharmaceutical companies. Under the terms of the agreement, a technology transfer of the manufacturing process for CABA-201 (an orphan drug designation for the treatment of systemic sclerosis) will be made from Cabaletta to Lonza, with the expectation that it will be able to supply Good Manufacturing Practice (GMP) products, which are standards that a drug manufacturer must meet, to support any current and planned clinical trials that evaluate CABA-201, including potential late-stage clinical trials for CABA-201.

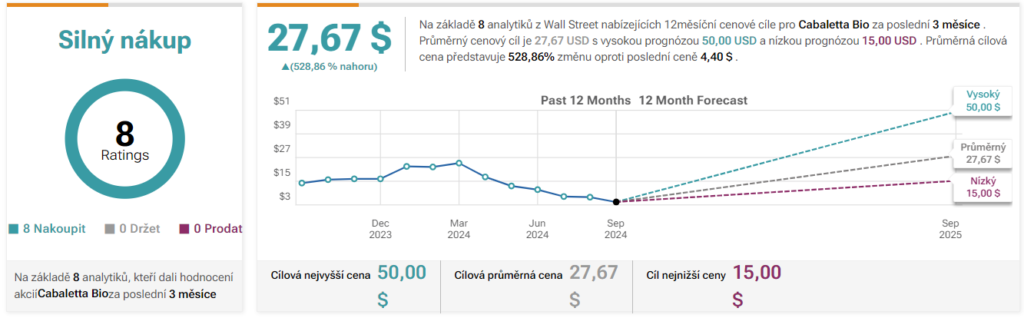

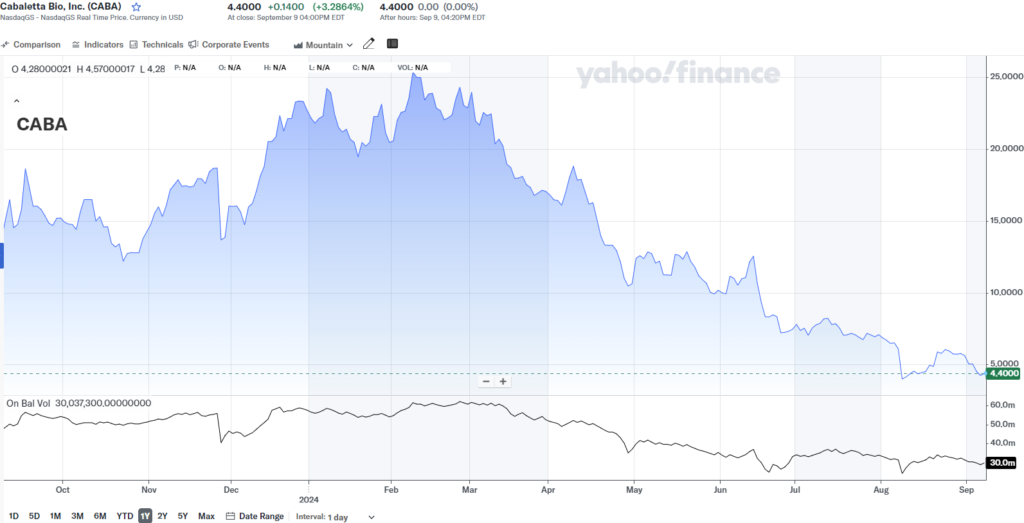

Also in August, the company expanded its original partnership with Cellares, the first integrated development and manufacturing organization dedicated to clinical and industrial cell therapy manufacturing, following a successful initial proof-of-concept technology transfer for manufacturing. The expanded partnership enables the potential to integrate Cellares’ manufacturing platform into the CABA-201 clinical program.These facts have attracted the attention of multinational investment corporations and private investors to purchase shares of Cabaletta Bio (NASDAQ:CABA) in particular, for which they expect strong share price growth, with an average target price of $27.67 per share set for the short- to medium-term investment horizon.

Graph Source : www.tipranks.com