AMD Releases Third Quarter 2024 Financial Results

Advanced Micro Devices Inc (NASDAQ:AMD) reported 3Q2024 earnings results on October 29, 2024. The company’s total revenue increased 17% year-over-year to $6.819 billion. The company’s operating profit rose 19% to $3.419 billion. After deducting all expenses, the company earned a net profit of USD 771 million with a respectable 158% year-on-year increase. AMD Chairman and CEO Dr. Lisa Su. said : “We delivered strong third quarter financial results with record revenue, which led to higher sales of our EPYC and Instinct data center products and strong demand for our Ryzen PC processors.” “Looking ahead, we see significant opportunities for data center, client and enterprise growth driven by the insatiable demand for high computing power.”

Advanced Micro Devices Inc. (NASDAQ:AMD) CEO Dr. Lisa Su said that data centers and artificial intelligence currently represent a significant growth opportunity for AMD. The company is building strong momentum for its EPYC and AMD Instinct processors across a growing group of customers. With the new EPYC processors, AMD Instinct GPUs and Pensando DPUs, AMD is delivering industry-leading computing performance for customers’ most important and demanding workloads. Looking ahead, Lisa Su also sees the data center AI accelerator market growing to $500 billion by 2028. The company is committed to delivering innovation on a global scale through its advanced silicon, software, networking and cluster solutions.

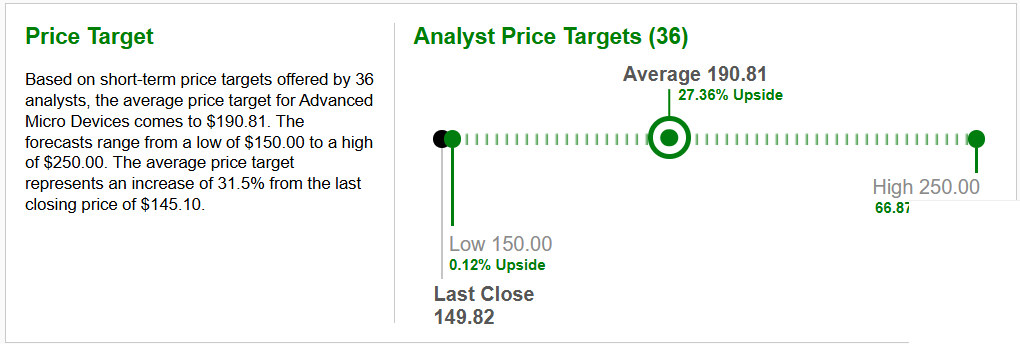

Partner, Google highlighted how AMD’s EPYC processors power a wide range of AI, high performance, general-purpose and confidential computing instances, including their AI Hypercomputer, a supercomputing architecture designed to maximize the return on investment in AI. Google also announced that virtual machines based on the EPYC 9005 Series will be available in early 2025. These facts have attracted the attention of multinational investment corporations and private investors to buy shares of Advanced Micro Devices Inc (NASDAQ:AMD) specifically, for which an average target price of $190.81 per share has been set for the short to medium-term investment horizon.

Graph Source : www.zacks.com