Nvidia Corp. sets record

Artificial intelligence (AI) chip leader Nvidia Corp (NASDAQ-NVDA) hit a new all-time high, buoyed by a strong third-quarter earnings report from close chipmaking partner Taiwan Semiconductor Manufacturing (TSMC), with which Nvidia Corp has partnered to create a new chip platform for next year, “Blackwell,” which is reportedly already sold out. Nvidia CEO Jensen Huang recently said demand for the new chips is “insane.” Globally, Nvidia has scored the majority when it comes to AI developments, as the stock has risen nearly 10x since early 2023, shortly after the launch of ChatGPT, which is powered by chips just from Nvidia Corp (NASDAQ-NVDA).

A strong sales forecast from TSMC by the industry has increased investor optimism about demand for processors used to power AI applications. Investment analyst Dan Coatsworth of AJ Bell said: “Nvidia is one of TSMC’s major customers, so the Taiwanese company’s results have a direct link to the US chip company.” TSMC’s U.S.-listed shares have doubled this year, lifting the company’s market capitalization above $1 trillion. Nvidia’s stock is up 180% since the start of this year thanks to investors pouring billions of dollars into the stock at the center of a booming Wall Street trade.

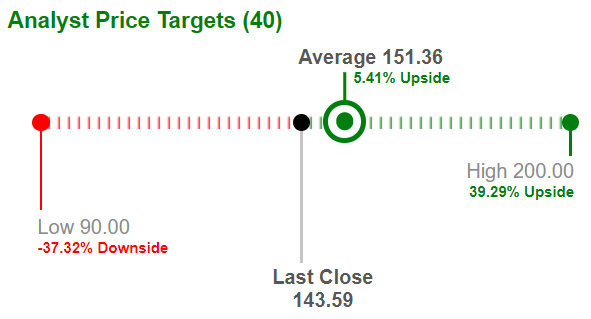

In Denver, CEO Jensen Huang described the company’s role in the development of artificial intelligence, as well as chips and hardware in the world. For example, the company is currently making AI services and models available to help robot makers accelerate the development of humanoid robots to help researchers teach robots how to perform certain tasks using devices such as Apple’s Vision Pro virtual glasses. The company also recently revealed at a conference in Denver, a future collaboration between Nvidia and Facebook in the areas of graphics and virtual environments. Nvidia Corp (NASDAQ-NVDA) also pays regular quarterly dividends to its shareholders. The dividend yield is currently 0.03% per annum and the actual dividend amount has been approved by the company’s general meeting of shareholders at $0.04 per share. The average target price for the short to medium term investment horizon has been set at $151.36 per share.

Graph Source : www.zacks.com