Builders FirstSource, Inc (BLDR)

Fundamental Analysis

Builders FirstSource is an American company that is the largest supplier of building materials in the US. It is headquartered in Dallas, Texas. The company has been traded on the NYSE since 1998 and has approximately 570 distribution centers in 43 states. Due to the growth in the value of its shares, the company was included in the S&P500 index in December 2023.

The construction market in the US is huge. By its own estimate, the company, while the largest, still achieves a market share of about 11% in the single-family home section. It has a market share of only 2% in the larger homes section. The company is achieving growth both organically and through acquisitions of other companies. Due to higher interest rates on mortgages, there has been some decline in building permit applications for single-family homes in 2022. Compared to 2021, the decline is approximately 30% to approximately 1,500,000 applications per month. But that is still roughly 250,000 more than in the pre-Covid era. At least 5 companies have bought in the last 6 years.

The company’s sales are growing, including a jump in 2021 (from $8.5 billion to $20 billion). This year’s sales are expected to be lower than 2022’s ($17 billion). The company’s PE is 12. The industry’s expected PE is 20. Manufacturing PMI is 47.4 for December. The company does not pay a dividend.

Results

Last quarter, the company achieved sales of USD 4.5 billion with gross profit of USD 1.5 billion. Net profit is expected to be around USD 450 million, which is in line with the company’s expectations.

Builders FirstSource is looking to focus more on ESG (reporting started in 2023 from early 2022) and on investing in its own employees. It has started training its staff more, investing in management development.

The company is investing heavily in IT and trying to offer new services to its customers through online platforms (scheduling portal, ordering) to save storage costs for both customers and itself.

Technical analysis

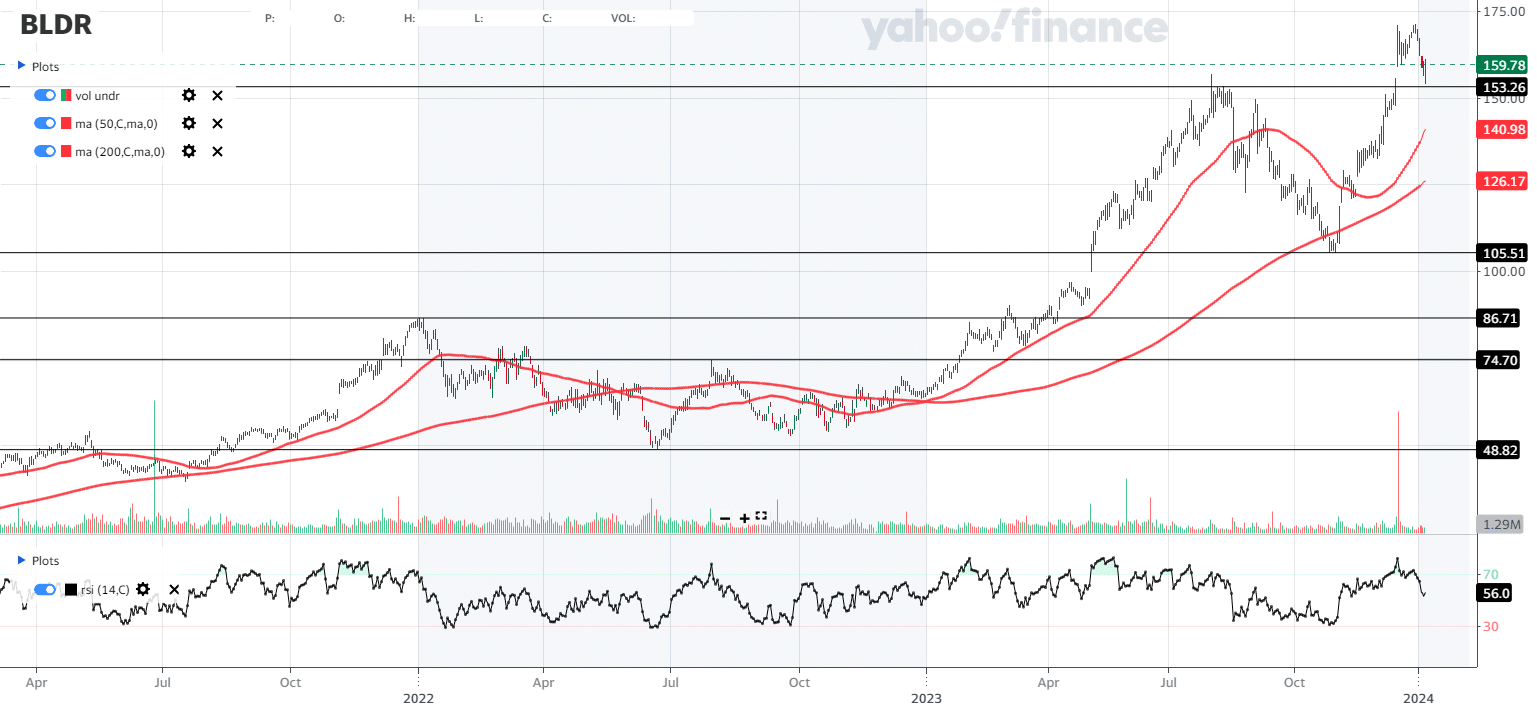

The stock price has rocketed in 2023 (more than 140%). The stock has added 50% to its value in the last quarter.

The moving averages are in an uptrend, and our RSI has returned to the neutral zone.

The price is near the resistance formed in August 2023 at around $150 per share.

Conclusion

The construction sector is quite buoyant. New building permit numbers are high despite the 2022 downturn. Despite higher mortgage rates, builders expect new home sales and more renovations. Of course, their contractors can benefit from this as well.

On the other hand, the stock has been quite volatile, having climbed as much as 50% in the last few weeks. And the PMI still shows a deteriorating outlook for the US economy.

Sources

https://seekingalpha.com/symbol/BLDR

https://finance.yahoo.com/quote/BLDR?p=BLDR&.tsrc=fin-srch

https://investors.bldr.com/events-and-presentations/default.aspx

https://s202.q4cdn.com/867695273/files/doc_events/2023/Dec/05/bldr-2023-investor-day-presentation-final_edgar.pdf

https://www.prnewswire.com/news-releases/uber-technologies-jabil-and-builders-firstsource-set-to-join-sp-500-others-to-join-sp-midcap-400-and-sp-smallcap-600-302003730.html

https://en.wikipedia.org/wiki/Builders_FirstSource

https://tradingeconomics.com/united-states/building-permits

https://www.ismworld.org/supply-management-news-and-reports/reports/ism-report-on-business/pmi/december/

https://simplywall.st/stocks/us/capital-goods/nyse-bldr/builders-firstsource/valuation