AMD to release financial results

Advanced Micro Devices, Inc. is currently one of the most popular titles among investors, primarily due to the expected release of its third quarter 2023 earnings on October 31. Revenue growth is expected to be strong. This fact was reported in as early as August this year by AMD’s Executive Multi President, CFO and Chief Accounting Officer Jean Hu, who said «Looking ahead to the third quarter, we expect double-digit growth in sales in our data center and client segments, as well as demand for our EPYC and Ryzen processors.»

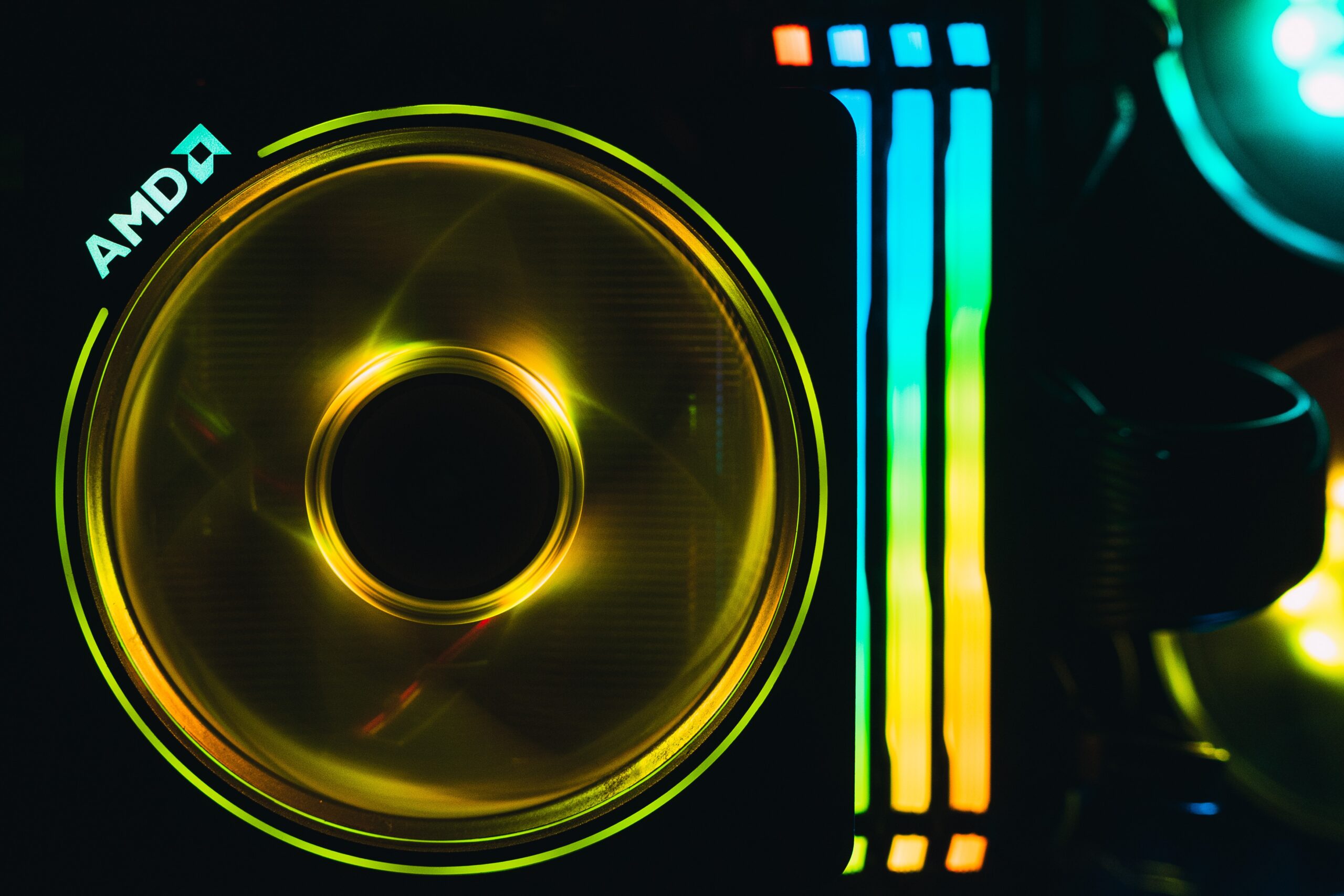

This is primarily due to the launch of new processors under the AMD EPYC 8004 series for data centres, according to the company. These new processors can provide up to twice the performance at low power consumption, which could save its users thousands of dollars in electricity costs over the next five years. ) The company also continues to deliver high-performance and accelerated computing for data centers, cloud and supercomputing, with AWS , Alibaba, Microsoft Azure and OCI announcing new instances powered by AMD EPYC 4th generation processors that enable single-service transaction processing, real-time data analytics and machine learning across cloud services. AMD also recently introduced new Ryzen™ PRO 7040 Series mobile processors and new Ryzen PRO 7000 Series desktop processors, bringing the high performance of «Zen 4» integrated graphics and second-generation AMD RDNA to professional desktop users.

AMD is poised to ramp up production of its flagship MI300 artificial intelligence chips in the fourth quarter, the company’s CEO Lisa Su said in August. The accelerator chips, which are in short supply, are designed to compete with the advanced H100 chips that Nvidia already sells. Su also said customer interest in the MI300 series chips is «very high» and AMD will expand its work with «top cloud providers, i.e. large enterprises and a number of leading AI companies» during the third quarter.

Worldwide analysts have set an average target price of $137.29 per share for Advanced Micro Devices, Inc. (AMD:NASDAQ) stock for the near to mid-term investment horizon.