Alphabet Inc. announces record growth and major innovations

Third Quarter 2024 Results

Alphabet Inc, the parent company of Google, saw impressive growth in the last quarter. Revenue reached $88.3 billion, a 15% year-over-year increase. Earnings per share rose 37%, net income was $26.3 billion and operating income climbed to $28.5 billion. The company is benefiting from success in various segments, particularly Google and Google Cloud. Google Cloud reported a 35% increase in revenue to $11.4 billion. Generative AI solutions and AI-focused infrastructure are attracting new customers and increasing product adoption by 30% among existing clients. YouTube is also celebrating a historic milestone – surpassing the $50 billion mark in combined ad and subscription revenue over the past 12 months.

Artificial intelligence as a driver of innovation

CEO Sundar Pichai highlighted the role of AI in the company’s strategy. New AI features are strengthening Google’s search capabilities and enabling faster development. Interestingly, a quarter of the code now comes from generative AI, which is then checked by engineers. The company is also investing in AI hardware, including its own Trillium processors.

Achievements in other areas

Alphabet also reported growth in the devices and subscriptions segment, where revenue for the first time includes new products such as Pixel 9, Pixel Watch 3 and Pixel Buds Pro 2. Waymo’s autonomous vehicle division continues to grow, with its cars now servicing over 150,000 paid rides per week and driving over one million autonomous miles .

Regulatory challenges

The company is facing an antitrust investigation that could threaten its position in the search engine market. Sundar Pichai highlighted the potential negative impact of regulatory intervention on the entire technology sector.

Conclusion

Alphabet Inc. continues to grow by investing in innovation, particularly in the area of artificial intelligence. Successes in key areas such as Google Cloud and YouTube demonstrate the strength of its strategy, although the company also faces regulatory challenges that will be key to its future direction.

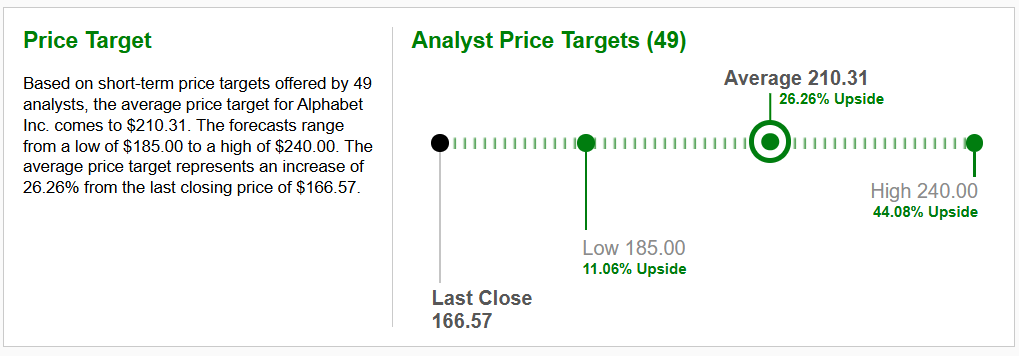

Chart Source : www.zacks.com

The company also pays a regular quarterly dividend to its investors, which currently has a dividend yield of 0.49%. The actual dividend amount was approved by the Company’s Annual General Meeting at $0.20 per share. The Company has also currently disclosed the last date for the use of the dividend payment (Ex-Div. Date) , which will be December 9, 2024 and the dividend payment date (Pay Date) , which has been set for 12/16/2024. According to multinational investment corporations, the share price of Alphabet Inc (NASDAQ-GOOGL), can be expected to be in a bull market trend, i.e., an uptrend in the share price. The average target price for the short- to medium-term investment horizon was set at $210.31 per share.