News from the Walt Disney Company

The Walt Disney Company (DIS) recently announced several key updates that could impact its future development and stock performance:

1. Feature film “Bluey”: On December 17, 2024, the company announced that it is developing the first animated feature film based on the popular series “Bluey” in partnership with BBC Studios. The move confirms Disney’s efforts to expand its content portfolio with more family-oriented projects.

2. Dividend declaration. This move reinforces investor confidence in the sustainability of the company’s financial stability.

3. Theme Park Expansion: In August 2024, Disney announced plans to expand its theme parks with new attractions inspired by films such as “Avatar,” “Indiana Jones,” “Encanto,” and “Monsters, Inc.” The move is intended to strengthen the experience segment and attract a wider audience.

Financial Results for the 4th Quarter of Fiscal Year 2024 The Walt Disney Company released financial results that signal steady growth in key areas of the business:

– Adjusted earnings per share came in at $1.14 on total revenue of $22.6 billion, beating analysts’ expectations.

– The Streaming segment (Disney+) reported an operating profit of $321 million for the first time, a significant improvement over the prior year.

– The Experiences segment (Parks and Resorts) saw a 6% year-over-year decline in operating profit, attributed to an increase in operating expenses.

In addition to these results, the company announced a $3 billion share repurchase plan and plans to further increase the profitability of the streaming division in 2025.

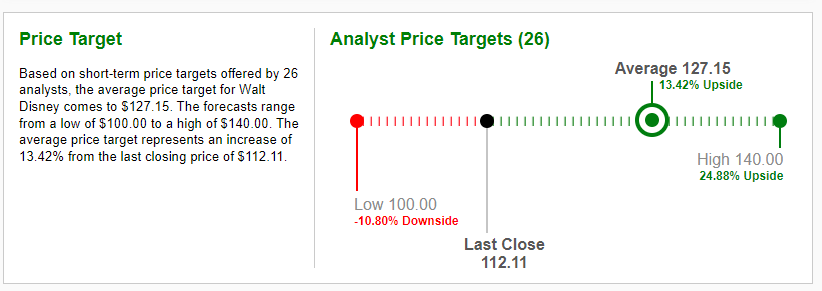

Current Stock Price Trend for Disney (DIS) As of December 18, 2024, shares of Walt Disney Company are trading at $113.02, up 0.81% from the previous day. Since the beginning of the year, the stock has appreciated 25%, confirming the positive trend and investor confidence in the company’s future development. %. Analysts predict a median target price of $127.15, which would represent a potential upside of 7.44% from the current value. The most optimistic forecasts reach up to USD 140 per share, underlining the market’s confidence in the company’s future performance. The company also pays a regular quarterly dividend to its shareholders. The dividend payout is $1 per share and the dividend yield is 0.89% per share.

Outlook and Recommendations Disney has demonstrated its ability to adapt to changing market conditions, primarily through innovation in content and streaming services. Investors should monitor further developments in the streaming division, theme parks, and monetization of new projects.

Graph Source : www.zacks.com