Delta Airlines

Fundamental Analysis

Delta is one of the largest airlines in the world. It currently operates more than 900 aircraft. Its focus is on domestic US and transatlantic and transpacific flights. Although it carries all categories of passengers, it is the most focused on business travelers among other US airlines. Its rapid return to travel in 2023 is helping the company to grow rapidly.

In 2022, the airline’s capacity was at capacity over the summer. Further growth of 10-15% is expected in 2023.

The average ticket price has increased by 9% compared to pre-pandemic times.

Delta is trying to differentiate itself from competitors with the range of services it offers on board its aircraft. It is investing massively in digitalisation, with most wide-body aircraft equipped with superior entertainment systems.

The company was named the best airline in the Skytrax world airline award.

US companies generally do not hedge fuel prices like their European competitors. Compared to 2022, the price of oil is 20% lower.

The Vanguard fund owns 11% of Delta and 6% of Blackrock.

Results

Delta’s share price has risen 50% over the past few weeks.

Delta reported 2Q results on 7/13/2023.

The company experienced the best quarter in its history. Sales rose to $15.6 billion (+11%). Operating income rose $2.5 billion (+16.0%). Earnings per share rose to $2.84. This is also an increase in annual earnings per share from USD 5 to USD 7.

The company carried 10% more passengers on domestic routes and 61% more passengers on transatlantic routes. For 3Q2023, the company expects passenger growth of 10-20% compared to 2022.

Fuel price decreased by 22% compared to 2Q2022. Current oil prices have been unchanged for several weeks.

The company’s PE is 10, the industry average is 12.6.

Technical analysis

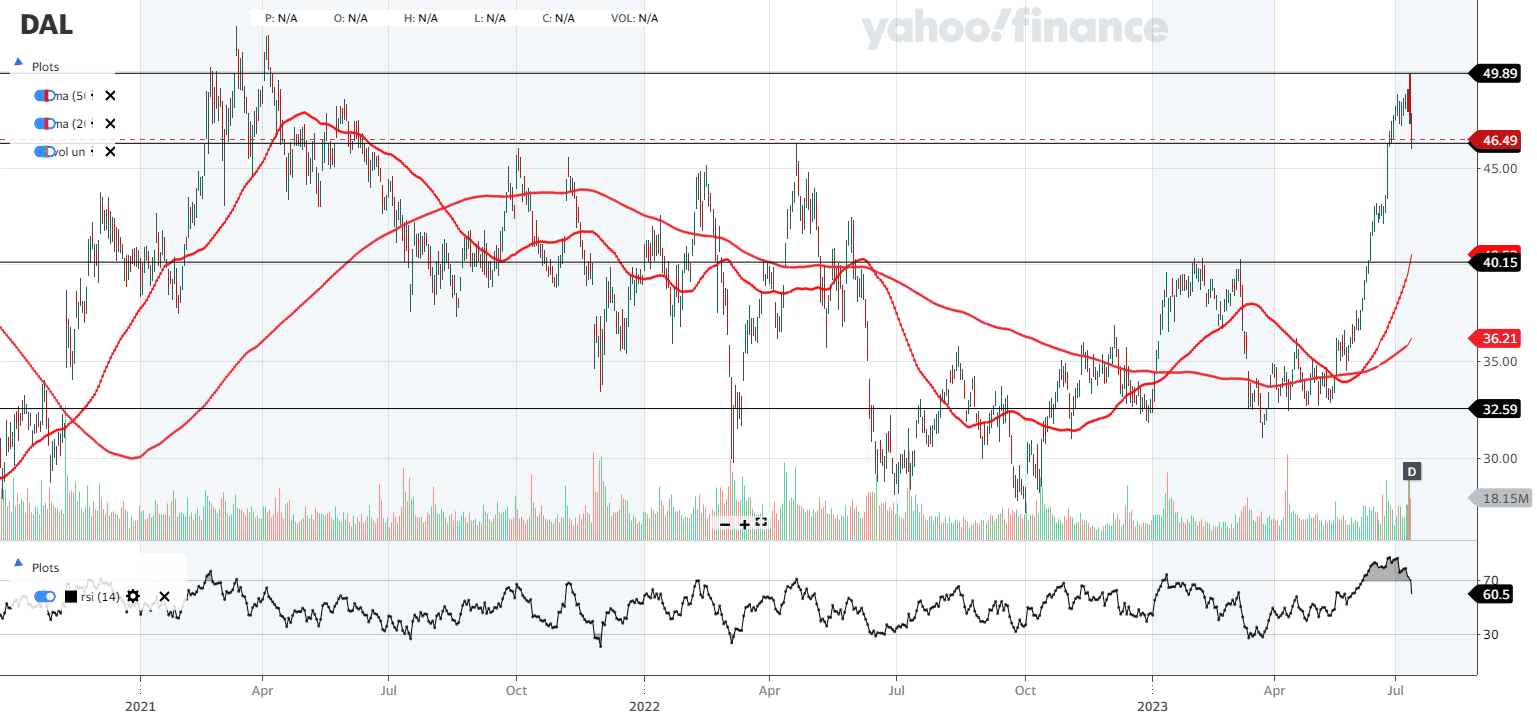

Moving averages point to an upward trend. RSI, on the other hand, is in the overbought zone. However, after such a strong rise, the RSI cannot be anywhere else either. The stock has paused on resistance at $50.

Price action of the head and shoulders formation did not take place, there was no break of the support at USD 33 and the subsequent journey of the share price down.

Conclusion

Delta is going through a strong period. Business travelers are back on planes, and economy class passengers are less price sensitive. The industry average ticket price is rising. In contrast, the price of oil is stagnant and Delta is benefiting from its brand. The second quarter produced the best results ever. The outlook for the third quarter is even more interesting. In the medium term, the stock could strengthen further if the company’s estimates come true.

On the other hand, technical analysis is giving conflicting signals. Resistance at the $50 price level is very strong, and historically the price has often bounced down from it. If Delta misses its estimates, the share price could fall. Technical analysis would also support a decline, as the resistance at the $50 price is unlikely to be broken.